What Is The Difference Between Desktop Appraisals And Full Appraisals?

8 Comments A common question I get is, “What is the difference between a desktop appraisal and a full appraisal?”

A common question I get is, “What is the difference between a desktop appraisal and a full appraisal?”

I’ll be the first to say that there aren’t many differences between the desktop appraisal and the full appraisal in terms of the comparable selection and the research. However, as with any two different things, there are factors to consider in determining which works better for you and your situation. The first thing I recommend is to find out if the intended user will accept a desktop appraisal or if they will require a full appraisal. Once you have this answer, then you can discuss which appraisal type makes sense for you.

So that you have some background, here is information on the two types of appraisals:

The desktop appraisal is a valuation performed without a physical inspection of the property. All research is done as the name suggests, from the appraiser’s desk.

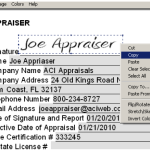

A desktop appraisal is made based on tax records and a multiple listing service (MLS). Here is a sample of a single family home desktop appraisal done by one of our certified appraisers.

A full appraisal means that an appraiser visits your home and takes photos, measures and evaluates in person the condition of your home. Here is a sample of a full appraisal for a single family home done one of our certified appraisers.

A desktop valuation is a great tool for homes that are in average condition. Full appraisal evaluations are recommended for homes that are in poor or highly upgraded condition. Full appraisals are also recommended for tax appeal cases and divorce in which someone might be disputing the value.

Discuss your property and needs with one of our appraisers before making any final decisions. Please keep in mind that a proper assessment of your home or condo is far more important in the long run than some money that you may save immediately.

Let us know, are you in the process of deciding between a desktop valuation or a full appraisal? What are some of your determining factors?

Tags: 2013 real estate, appraisal, appraisal questions, appraisal questions answered, appraisal sale, computer appraisal, desktop appraisal, does your appraiser, field appraisal, full appraisal, home appraisal, home valuation, on site appraisal, property appraisal, valuation, what is an appraisal, what is appraisalCategorised in: Blog, Reasons To Get An Appraisal

This post was written by Joseph Castaneda

8 Comments

I am renting a home and would consider buying it. I have concerns that I will need to put a significant investment into the home (roof, porch, pool, siding, HVAC, trees, and other items). As a renter can I have you come in to do an appraisal?

Thank you,

Lon McPherson

Ocala, FL

Hi, Yes you can order an appraisal for that exact reason. It is very common that we do an appraisal for this exact reason. Please be advised however that the appraisal can not be used to obtain financing. If you were to get financing the bank will require that they randomly select their own appraiser.

Concise and to the point. Very nice. Desktop appraisals and full appraisals really are the same thing minus the inspection. That’s why I prefer them over a full appraisal any day of the week. Driving is always the killer.

I am a victim of Real Estate Fraud and it would have never happened if the Bank of Nova Scotia had done a full appraisal and not just a “desktop” appraisal.. When the bank came after my house, we went to court. Yes, I won and yes it was good for my ego to win since I represented myself, , however this cost me 5 years of my life that were hell plus a lot of money.

Hi. We built a new house and house was ready to move in a year ago. We would like to refinance our mortgage. Is it necessary to have an appraisal when it is a new home? Also, if we need one to refinance, is appraisal cost the same for either a desktop appraisal vs. a full appraisal?

Thank you so much.

M. Cheney

LakeWorth, FL

Hi, Even new houses need to have an appraisal done for a refinance. A Desktop appraisal cost less than a full appraisal, however for a refinance the bank will require a full appraisal.

Very helpful article. So here in PA full appraisals are on hiatus due to the COVID-19 pandemic. I have to get the house appraised as part of a divorce, with the valuation to be backdated to when the divorce was final. I’m the one staying, and so I have to buy out the ex. My lawyer thinks it might be more to my advantage NOT to wait for the pandemic to blow over, I think because of the backdating, which would mean havng to get the desktop version. Do you have an opinion? Neither party would dispute the valuation–that’s not an issue.

If neither party would dispute valuation than it does not make a difference. The most accurate appraisal is when the appraiser can go into the house to see the upgrades or lack there of.